Social Security

FIQ healthcare professional members are insured with Beneva and have group insurance that includes a modular health insurance plan and optional dental care plan.

If you want to make changes to your coverage or have questions, you can also go to beneva.ca/fiq.

Insurance documents

Your insurance contract, coverage schedule and rate sheet are available here:

https://www.beneva.ca/en/group-insurance/fiq

Disability

It you are age 60, on disability and intend to apply for your pension from the Québec Pension Plan (QPP), it is important to obtain information before doing so. In fact, even if your employer or insurer has not yet asked you to apply for the QPP disability pension, they could do so. You cannot receive the QPP retirement pension and QPP disability pension at the same time. You would have to cancel your retirement pension and reimburse money to Retraite Québec. If you are in this situation, contact Retraite Québec or the FIQ Social Security Sector for more information.

Logbook disability 10th edition

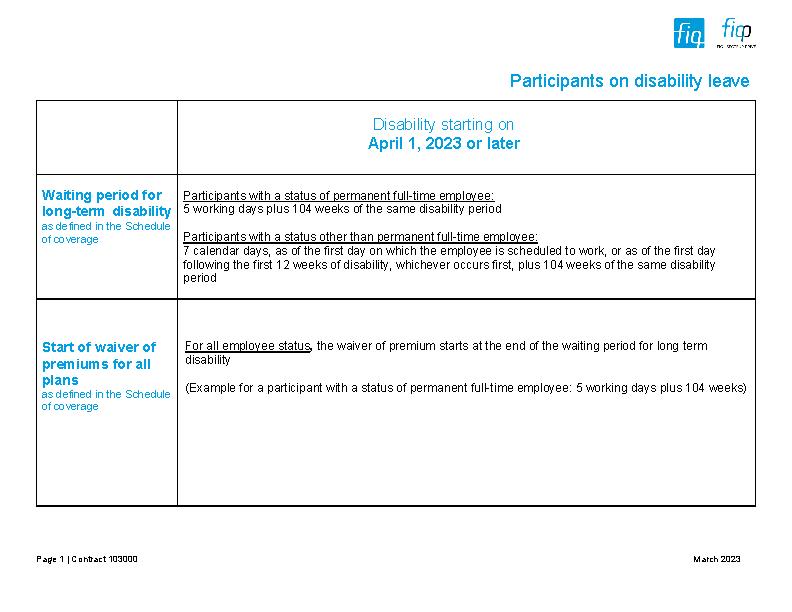

If your disability started on or after April 1, 2023, please review the changes to your group insurance contract.

Disability starting on April 1, 2023 or later

Benefits offered to FIQ members

The Caisse Desjardins du Réseau de la santé is the exclusive financial institution for the healthcare system’s personnel where the members’ assets invested in the Caisse are reinvested in the sector to support health workers.

Engaged in its community for several years, the Caisse offers you, as a FIQ union member, an array of competitive benefits and services for you and your family.

In a nutshell…

- An accessible and pioneering provincial financial institution, created by and for the people in the healthcare field;

- A group of financial experts and subsidiary specialists (VMD, The Personal, etc.);

- Mobile, virtual and telephone consulting services at the time and place convenient for you, 7 days a week, 24 hours a day;

- Financial flexibility for workers with precarious or part-time jobs with the TREMPLIN Desjardins program for returning to school;

- Significant amounts reinvested every year for health workers;

- Free conferences (budget, mortgage, personal finances, etc.);

- An active partnership with different unions in the health sector;

- In-depth expertise of the RREGOP pension plan;

- Analysis and retirement training sessions for workers (Caisse-Régie des rentes du Québec-CARRA);

- An improved provincial group RSVP in the health sector;

- A full range of competitive and adapted financial products and services including complementary products and group insurance;

- A place where the benefits of the cooperative distinction are fulfilled.

For sound advice about your finances…

One number, toll free: 1 877 522-4773

One of our advisors will know how to find THE solution for you